The Corporate Transparency Act - The Silent Wrecking Ball Set to Expose the Puppet Masters

How January 1, 2025, Will Unravel Decades of Corruption and Shine a Light on the Hidden Architects of Control

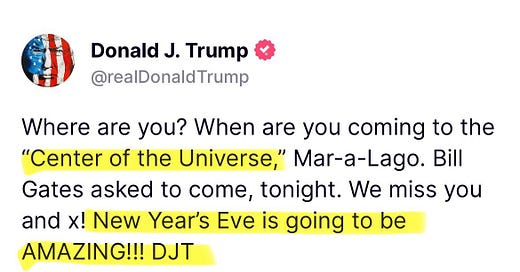

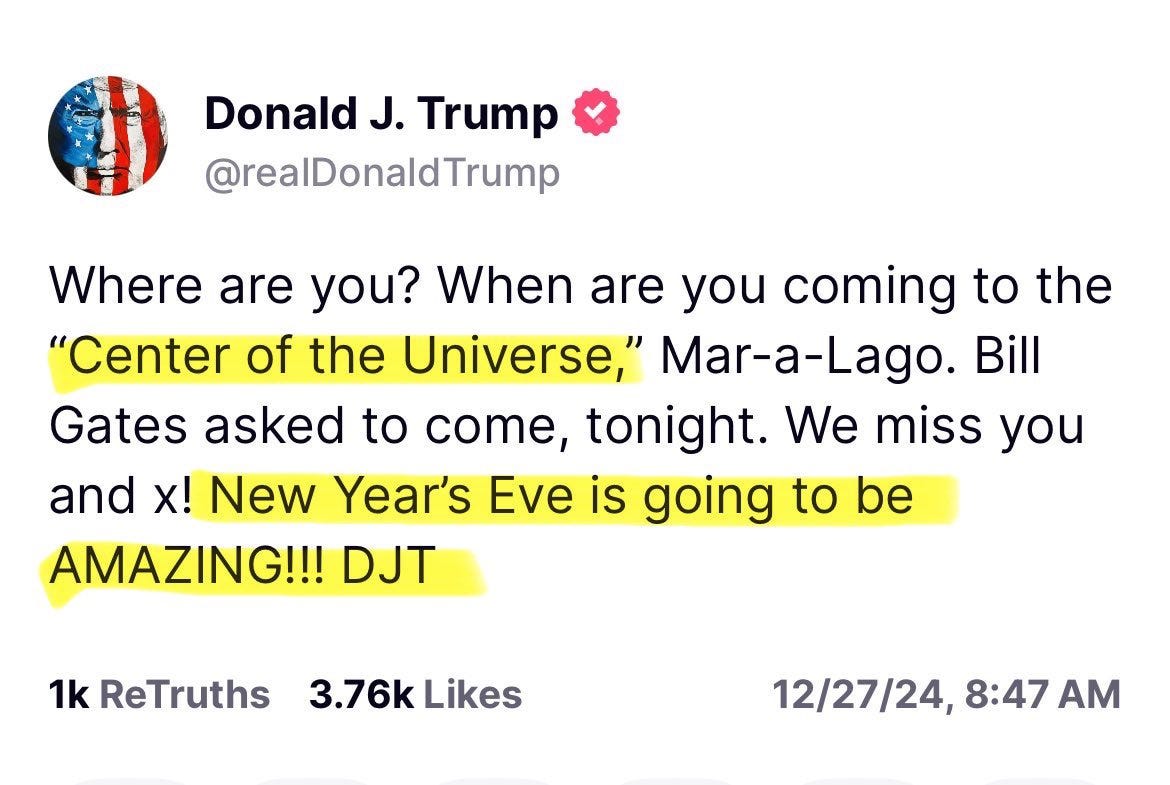

Trump said it in September 2024: “The biggest thing that nobody even knows about. It’s all signed and goes into effect on January 1st.” - DJT

There’s a ticking time bomb quietly set to go off on January 1, 2025, and almost no one is talking about it. That’s not an accident, it’s by design. The Corporate Transparency Act (CTA) is one of the most under-the-radar moves in this entire operation. This isn’t just another piece of legislation. This is a weapon that’s going to shine a blazing spotlight on the real puppet masters pulling the strings. We’re talking about the top of the food chain, the apex predators who’ve been hiding behind shell companies and opaque financial networks for decades.

This is COOP/COG (Continuity of Operations/Continuity of Government) on steroids. It’s precision-engineered to expose the shadow system that’s been propping up the Cabal. And here’s the kicker: it’s all signed, sealed, and ready to go. The groundwork is laid. The foundation is set. The only thing left is for the curtain to rise and the world to see what’s been going on.

Why January 1, 2025, Matters

The CTA mandates that every corporation and LLC in the U.S., and we’re talking about millions of entities here, report their real owners to a centralized database maintained by FinCEN. Not proxies. Not figureheads. The actual beneficial owners who control 25% or more of these entities. This is where the system starts to unravel.

For new companies, this has already been in effect since January 1, 2024. But here’s the critical date: January 1, 2025. That’s the deadline for all existing entities to comply. Translation?

Every legacy shell company, every shadowy corporate structure hiding dirty money or criminal agendas, has until this date to come clean, or face the consequences.

What’s Really Going on Here?

This isn’t about regulating small businesses or creating paperwork for honest folks. This is a trap, carefully set to flush out the rats. Think about how the Cabal operates. They use layers of shell companies and offshore accounts to:

Launder money.

Fund black ops.

Manipulate governments, media, and markets.

Hide their real agendas.

This law blows that system wide open. Once the disclosures start rolling in, it’s like pulling a thread on a carefully woven web. The entire thing begins to unravel, and the names of the real power brokers, the puppet masters, start to surface. These aren’t just mid-level operatives or talking heads. We’re talking about the architects of the system, the ones who have stayed hidden while controlling the narrative from behind the scenes.

How Does This Fit Into COOP/COG?

This is where it gets good. Continuity of Operations (COOP) and Continuity of Government (COG) have always been about ensuring the survival of a legitimate system during times of crisis. But what happens when the system itself has been hijacked? What happens when the government, the corporations, and even the media are all infiltrated? You burn out the infection. You expose the rot. And then you rebuild.

The CTA is a scalpel in that process. It’s not flashy, but it’s deadly effective. By forcing transparency at every level, it strips away the tools the Cabal uses to operate. It removes their ability to hide their money, their networks, and their power.

How This Points the Finger at the Top

Think about what’s coming:

The real owners of media conglomerates are exposed. Suddenly, it’s no longer a mystery why every major outlet pushes the same narrative. The strings connecting them to political operatives and globalist agendas are laid bare.

The entities funding election interference and dark money campaigns are revealed. No more anonymous donors, no more shell companies funneling billions to manipulate outcomes.

The hidden financial flows behind human trafficking networks, bioweapon development, and other crimes against humanity are traced back to their source. Not just the foot soldiers, the architects.

This isn’t speculation. This is precision engineering. The Cabal relies on obfuscation. Their power lies in their ability to stay hidden, to operate in the dark. The CTA flips the lights on.

Why the Silence?

Ask yourself: Why isn’t anyone talking about this? Why aren’t the media, the talking heads, or the so-called watchdogs covering what’s coming? Because they know. They know what this means. The silence is the loudest admission of guilt you’ll ever hear. The ones who benefit from this system are the same ones controlling the narrative. They’re hoping to run out the clock, to find a loophole, to delay the inevitable. But the clock is ticking, and January 1, 2025, is coming like a freight train.

How This Ties to Trump’s Strategy

You’ve heard Trump talk about moves that “nobody is talking about” and how the biggest things happening are behind the scenes. This is exactly what he’s referring to. This law aligns perfectly with the larger mission to drain the swamp and dismantle the Deep State. It’s part of a broader COOP/COG framework that’s been in motion for years.

Trump and the patriots didn’t just start this fight in 2016. This has been a multi-decade operation to dismantle a system that’s been entrenched for over a century. The CTA is one of the final tools in the arsenal, designed to pull the rug out from under the puppet masters at the exact right moment.

What Happens Next

The dominoes are lined up. The CTA is the nudge that starts them falling. Once the disclosures begin, here’s what to expect:

Names and Connections - The public will see who’s really in control of corporations, media, and industries. The financial ties to foreign governments, criminal networks, and globalist agendas will come to light.

Prosecutions and Accountability - With the web of ownership exposed, law enforcement and military operations have the evidence they need to start dismantling these networks.

Global Awakening - This isn’t just about the U.S. The exposure of these systems will ripple across the globe, dismantling corruption and criminal agendas worldwide.

The Bottom Line

This isn’t just another law. This is a cornerstone of the entire COOP/COG strategy. It’s a wrecking ball aimed directly at the foundation of the Cabal’s power. They can’t hide anymore. They can’t obfuscate. The CTA will point the finger directly at the puppet masters, and all their crimes - treason, fraud, crimes against humanity - will be laid bare.

So, stay sharp. Keep your eyes on January 1, 2025. The silence is deafening, but the truth is coming, and it’s going to shake the world.

Check out my account on X: Observing Consciousness

“They’re hoping to run out the clock, to find a loophole, to delay the inevitable. But the clock is ticking, and January 1, 2025, is coming like a freight train.”

It’s a nice idea. But it won’t work as you speculate. The CTA has exemptions built-in for the following categories:

- Financial entities

- Private Equity entities

- Investment Firms

- companies with 10 or more employees

- Entities earning $5,000,000 or more annually

The CTA was passed as an addendum to the Inflation Reduction Act. This was a Biden move to easily track small business owners to more easily tax them and impose income tax enforcement.

The same act authorized the IRS to hire 80,000 additional employees for “Corporate Tax Audit and Enforcement” purposes. It includes 2500 armed tax enforcement officers. Translated: they need enhanced small business owner tax revenue to offset their out of control government spending.

I’m with you Featherjourney! We know about COG. We see it playing out bit by bit. We know that Biden has extended or not stopped certain Trump E O’s and that he and Jill hate Obama, Pelosi etc. who stopped his campaign for POTUS. He or maybe he and Jill screwed up their plan to bring in Michelle by endorsing Kamala immediately. They were trapped! 😂 He has no loyalty to them or anyone else now. So let’s see what happens! No one except Trump and a handful of of people know exactly what is going on! I trust Trump period!